In a bold move that has caught international attention, former President Donald Trump expressed his intent to allow American oil companies to return to Venezuela following a US military operation targeting Nicolás Maduro. The aim: to access the South American nation’s staggering oil reserves.

Venezuela holds the largest proven oil reserves in the world, totaling 303.221 billion barrels, surpassing both Saudi Arabia and Iran. Yet, the country produces far less than its potential—currently around 1 million barrels per day, compared to 3.5 million barrels per day in 1999, when Hugo Chavez rose to power. Experts point to decades of neglect, corruption, and underinvestment as the reasons behind this decline. Sanctions imposed during Trump’s first term further shrank production to 350,000 barrels per day in 2020, marking a historic low.

To navigate these sanctions, Venezuela has relied on complex workarounds. China reportedly imports 80% of its oil, while Cuba receives 5% under bilateral agreements. Some shipments have even used so-called “ghost tankers,” such as the M/T Skipper, intercepted by the US Navy while transporting over a million barrels, reportedly destined for Cuba. Many payments are conducted in cryptocurrency, including stablecoins like USDT, to avoid financial restrictions.

American oil companies maintain a small footprint in Venezuela. Chevron continues operations under a special license, allowing exports and partnerships with the state-owned oil company, though profits are now often paid in crude rather than cash. Other major US players, like ExxonMobil and ConocoPhillips, exited in 2007 after disputes over Venezuelan government demands.

Trump’s interest in Venezuelan oil is framed in terms of both energy security and financial repayment. He emphasized the importance of being surrounded by “safe, secure countries” with access to energy and insisted that the US would be “repaid for everything” it has invested in Venezuela. Analysts note that Trump also views the oil exported under embargo as “stolen from the international community”, with China’s influence in Latin America—including control over transit points like the Panama Canal—also a factor in US strategic planning.

However, experts are skeptical about the feasibility of Trump’s plans. Infrastructure in Venezuela has deteriorated, and investment is risky amid fluctuating oil prices, global supply surpluses, and geopolitical tensions like the ongoing Ukraine conflict. Analysts warn that major US oil companies are primarily accountable to their shareholders, not government ambitions, making a large-scale return unlikely in the near term.

As for the market, any disruption in Venezuelan oil is expected to have only a marginal effect on global prices. More attention may shift to other geopolitical threats, such as Trump’s recent warnings regarding Iran, which produces far larger quantities of oil than Venezuela.

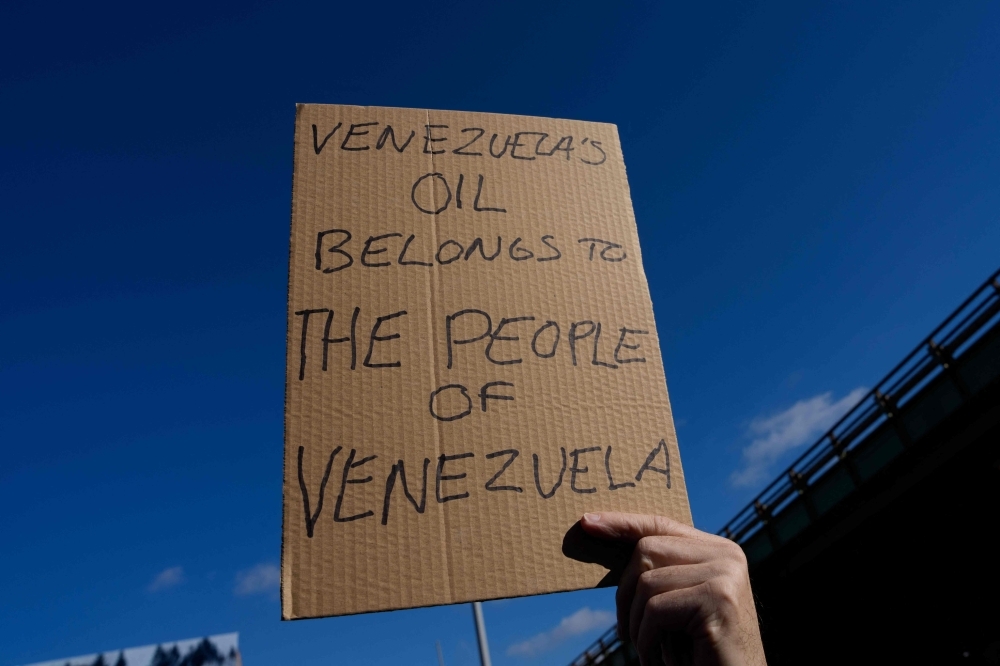

Ultimately, the story of Venezuelan oil is more than geopolitics—it’s a reflection of how natural resources, global ambitions, and human decisions collide. Behind the headlines and sanctions, it’s the Venezuelan people who continue to live under the consequences of decades of mismanagement, sanctions, and international power struggles. Their resilience in the face of these challenges is a human story often overshadowed by political headlines.